WASHINGTON — In a defining moment for the global semiconductor industry, the Trump administration has finalized a landmark trade pact with Taiwan, securing a staggering $250 billion in direct investments for American AI chip manufacturing. The deal, signed Thursday, slashes U.S. tariffs on Taiwanese imports to 15% and establishes a new framework for securing the critical technology supply chain against geopolitical volatility.

A New Era for the U.S.-Taiwan Trade Agreement 2026

The agreement marks the culmination of months of high-stakes negotiations led by Commerce Secretary Howard Lutnick. Under the terms of the U.S.-Taiwan trade agreement 2026, Taiwan’s technology sector has committed to injecting $250 billion into the U.S. industrial base, specifically targeting advanced semiconductor fabrication and artificial intelligence infrastructure. In a move to facilitate this massive capital influx, the Taiwanese government will provide an additional $250 billion in credit guarantees to support its companies expanding stateside.

“This is the ‘Taiwan Model’ of economic partnership coming to fruition,” said a senior Commerce Department official. “We are not just buying chips; we are rebuilding the entire ecosystem of AI chip manufacturing US soil.” The deal effectively de-escalates recent trade tensions, replacing the threat of punitive levies with a cooperative framework that prioritizes national security and industrial independence.

TSMC Leads the Charge with Massive Arizona Expansion

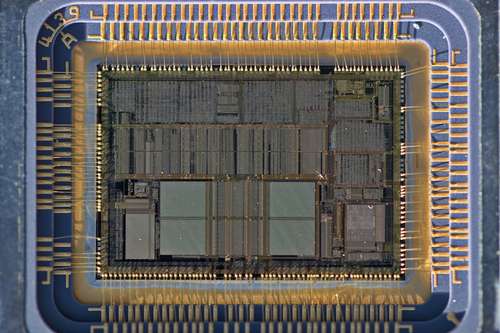

At the heart of this historic pact is Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s dominant chipmaker. As part of the TSMC $250 billion investment initiative, the company has confirmed plans to significantly expand its footprint in Arizona. Reports indicate that TSMC has already acquired hundreds of acres adjacent to its existing Phoenix facilities to accommodate new fabrication plants (fabs).

These new facilities are expected to produce the most advanced 2-nanometer and A16 chips, critical for powering next-generation AI models used by U.S. tech giants like Nvidia and Apple. Commerce Secretary Lutnick highlighted that this expansion ensures the U.S. will host a self-sufficient semiconductor supply chain capable of meeting domestic demand without relying on cross-Pacific logistics.

To accelerate construction, the deal includes a unique provision: Taiwanese companies building new U.S. factories can import up to 2.5 times their planned production capacity in materials and equipment duty-free during the construction phase. Once operational, they will retain a tariff exemption for imports equal to 1.5 times their U.S. output, incentivizing rapid completion and maximum output.

Slash in Taiwan Trade Tariffs Fuels Market Rally

For American consumers and businesses, a major victory lies in the reduction of import duties. The Trump administration has agreed to lower the “reciprocal” tariff rate on Taiwanese goods from 20% to 15%. This reduction applies broadly, while specific categories—including generic pharmaceuticals, aircraft components, and certain critical minerals—will now enter the U.S. completely tariff-free.

The announcement triggered an immediate tech stock market rally. TSMC shares jumped over 4% in trading, while major U.S. customers like Apple and Nvidia also saw gains as fears of supply chain disruptions subsided. Analysts predict that the lower Taiwan trade tariffs will alleviate inflationary pressure on consumer electronics, which had been a growing concern following earlier tariff threats.

“The market loves certainty,” noted a Wall Street strategist. “By locking in a 15% rate and securing domestic capacity, the administration has removed the biggest tail risk for the tech sector in 2026.”

Geopolitical Implications of the Deal

The Trump administration trade news sends a clear signal regarding the U.S. stance on technological sovereignty. By effectively “onshoring” a significant portion of Taiwan’s chip capability, the U.S. reduces its strategic vulnerability to potential conflicts in East Asia. The deal essentially mandates that if Taiwanese companies want access to the American market, they must build within it—a core tenet of President Trump’s industrial policy.

Taiwanese President Lai Ching-te’s administration has framed the deal as a necessary evolution of the island’s economic strategy, deepening ties with its most powerful security partner. While some critics in Taipei worry about the “hollowing out” of their domestic industry, the provision of credit guarantees suggests a coordinated effort to expand the pie rather than simply slice it differently.

As construction crews break ground on the new Arizona sites later this year, the focus will shift to execution. With $250 billion on the line, the race to build the factories of the future is officially underway, reshaping the global tech landscape for decades to come.