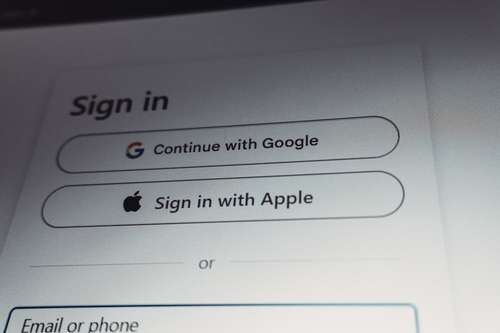

WASHINGTON, D.C. – The U.S. Federal Trade Commission (FTC) has launched a formal investigation into the landmark artificial intelligence partnership between Apple and Google, escalating its campaign against Big Tech consolidation. The probe, announced late Friday, focuses on the integration of Google's Gemini AI into Apple's Siri and iOS ecosystem, a deal that regulators fear could permanently entrench a duopoly in the mobile AI market.

This aggressive move marks a significant expansion of the FTC AI investigation strategy for 2026. Beyond the headline-grabbing Apple-Google alliance, the agency is widening its scope to target so-called "acqui-hires"—a controversial tactic where tech giants hire a startup's core talent and license its intellectual property to bypass traditional merger reviews. With recent high-profile maneuvers by Nvidia and Microsoft drawing regulatory ire, the industry is bracing for a watershed moment in Big Tech antitrust 2026 enforcement.

The Apple-Google Gemini Partnership Under the Microscope

At the heart of the investigation is the multi-billion dollar agreement to weave Google's Gemini models directly into the fabric of the iPhone's operating system. While framed by both companies as a non-exclusive software integration, regulators argue the deal effectively neutralizes competition in the nascent market for on-device AI agents.

According to sources close to the investigation, the FTC is examining whether the Apple Google Gemini partnership disincentivizes Apple from developing its own proprietary search and AI technologies, thereby maintaining Google's dominance in search while granting Apple a shortcut to AI competency. Critics, including xAI founder Elon Musk, have blasted the deal as an "unreasonable concentration of power," suggesting it creates an insurmountable barrier for independent AI labs trying to reach mobile users.

"If the two gatekeepers of the mobile economy agree to share the keys to the AI kingdom, it stops being a partnership and starts looking like a cartel," said a senior antitrust analyst involved in the probe. The investigation comes just months after Judge Amit Mehta's ruling regarding Google's search monopoly, raising questions about whether this new Google Siri AI deal violates the spirit of those remedies.

Nvidia and the 'Acqui-hire' Loophole

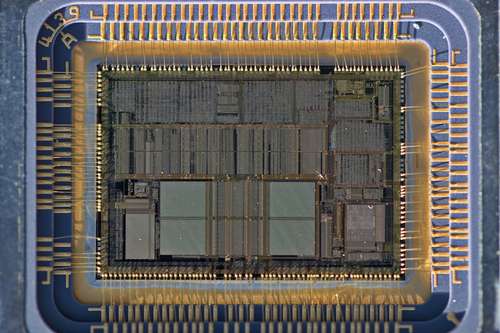

The FTC's scrutiny extends well beyond Cupertino. The agency is simultaneously conducting a Nvidia talent acquisition probe, zeroing in on the chipmaker's recent $20 billion transaction involving AI infrastructure startup Groq. In a move widely cited as the catalyst for the new crackdown, Nvidia secured non-exclusive licenses to Groq's technology and hired nearly 90% of its engineering workforce, including founder Jonathan Ross.

Regulators characterize this transaction as a "stealth merger." By structuring the deal as a talent transfer and IP license rather than a corporate acquisition, Nvidia avoided triggering the standard Hart-Scott-Rodino (HSR) antitrust review process. The AI acqui-hire scrutiny is now focused on closing this loophole. FTC officials have indicated they may retroactively classify such deals as mergers if the practical effect is the elimination of a competitor.

The Mechanics of Evasion

The "acqui-hire" model has become the preferred playbook for Silicon Valley in 2025 and 2026. Following Microsoft's earlier absorption of Inflection AI's staff and Amazon's similar deal with Adept, companies have realized they can acquire capabilities without acquiring liabilities—or regulatory headaches. However, the sheer scale of the Nvidia-Groq deal appears to have forced the FTC's hand, prompting a re-evaluation of how AI industry regulation is applied to human capital transfers.

A New Era of Enforcement in 2026

The timeline for these investigations suggests a turbulent year ahead for the tech sector. The FTC has issued subpoenas demanding internal communications regarding the negotiation of these partnerships, looking for evidence of intent to suppress competition. For Apple and Google, the probe threatens to delay the rollout of advanced Siri features slated for iOS 26.4, potentially leaving a window open for competitors like OpenAI and Anthropic to gain ground.

Legal experts predict that Big Tech antitrust 2026 cases will hinge on the definition of "market power" in the generative AI era. Unlike traditional monopolies built on supply chains or distribution networks, AI dominance is defined by access to data, compute, and—crucially—talent. By targeting the "acqui-hire" mechanism, the FTC is signaling that it views the hoarding of top-tier researchers as a form of anti-competitive foreclosure.

As the investigation unfolds, the industry faces a new reality: the days of unrestricted talent poaching and strategic alliances may be over. If the FTC succeeds in unwinding or penalizing these deals, it could force a complete restructuring of how Silicon Valley innovates, compelling giants to build rather than buy their way to AI supremacy.