The Internal Revenue Service (IRS) has officially confirmed the start of the 2026 tax season, announcing that it will begin accepting and processing individual 2025 tax returns on Monday, January 26, 2026. With the April 15 deadline looming on the horizon, the agency is urging taxpayers to prepare early and leverage new digital advancements designed to streamline the filing process. This year marks a significant shift in taxpayer assistance, as the IRS rolls out upgraded AI-driven tools to help filers navigate complex questions and expedite their 2026 tax refund.

Key Dates for the IRS 2026 Tax Season

Marking your calendar is the first step toward a stress-free filing experience. While tax software companies may accept submissions earlier in January, the IRS will not begin processing them until the official opening date. Here is the essential schedule for the tax filing start date and subsequent deadlines:

- January 26, 2026: Official start date. The IRS systems open to receive and process electronic returns.

- January 31, 2026: Deadline for employers to mail W-2 forms and for businesses to issue certain 1099 statements.

- February 15, 2026: The approximate date when refunds claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) will begin to be released, per the PATH Act.

- April 15, 2026: The official tax filing deadline for most Americans. It is also the deadline to file Form 4868 for an automatic six-month extension.

- October 15, 2026: The final deadline for those who requested an extension.

New Tech: IRS E-file 2026 and AI Assistance

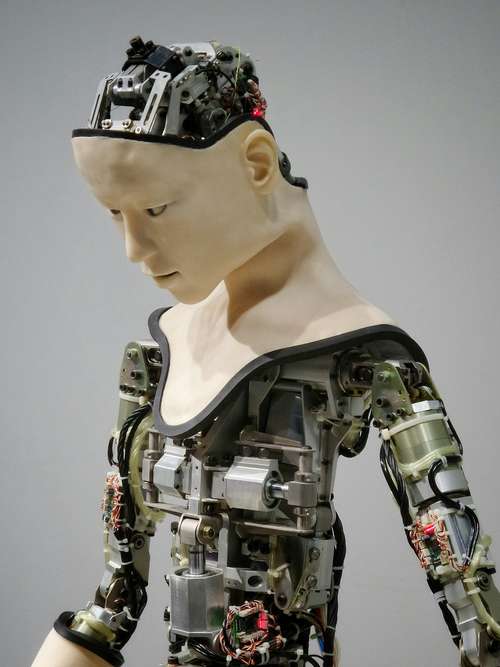

The biggest headline this season is the agency's modernization efforts. For the IRS e-file 2026 season, the service has introduced sophisticated AI-powered chatbots and voicebots aimed at reducing phone wait times. These tools can now handle more nuanced inquiries, such as helping users track their tax refund schedule 2026, set up payment plans, or answer questions about complex deductions without needing a human agent.

"Our goal is to resolve simple queries instantly so our specialized agents can focus on complex taxpayer issues," an IRS spokesperson stated during the announcement. Taxpayers are encouraged to use these digital assistants available on IRS.gov before calling the main helpline.

Inflation Adjustments: What’s New for Your 2025 Return

While tax rates remain consistent, the brackets and standard deduction amounts have been adjusted for inflation, which could impact your final tax bill or refund size. For returns filed in 2026 (covering the 2025 tax year), the standard deduction has increased:

- Single Filers: $15,750 (up from the previous year)

- Married Filing Jointly: $31,500

- Heads of Household: $23,625

These increases mean that many taxpayers may find it more beneficial to claim the standard deduction rather than itemizing. Additionally, the maximum contribution limit for 401(k) plans for the 2025 tax year was $23,500, a figure early filers should verify against their W-2s to ensure they maximized their tax-advantaged savings.

Tax Refund Schedule 2026: When to Expect Your Money

For most early filers, the burning question is: "When will I get my money?" The IRS anticipates issuing nine out of 10 refunds within 21 days for taxpayers who file electronically and choose direct deposit. Paper returns, as always, will take significantly longer—potentially 4 to 6 weeks.

The PATH Act Delay

It is crucial to remember that if you claim the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), the law requires the IRS to hold your entire refund until mid-February. This fraud-prevention measure ensures that the agency has time to verify income details. Early filers affected by this should not expect to see funds in their bank accounts before February 27, 2026, at the earliest.

Early Tax Filing Tips for a Faster Refund

To avoid delays and ensure your return is processed smoothly, follow these early tax filing tips:

- Wait for All Documents: filing before you receive all your W-2s, 1099s, or 1098s can lead to processing delays or the need to file an amended return later.

- Go Digital: Combine IRS e-file 2026 with direct deposit. This is the single most effective way to speed up your refund.

- Double-Check SSNs: A simple typo in a Social Security number is one of the most common reasons for rejected returns.

- Use Free File: Taxpayers with an Adjusted Gross Income (AGI) of $79,000 or less may be eligible to use IRS Free File software partners to file their federal return at no cost.

As the IRS 2026 tax season kicks off, patience and preparation are your best assets. By utilizing the new digital tools and filing electronically, you can navigate the season efficiently and secure your refund as quickly as possible.